India’s Financial Inclusion Journey Gains Momentum

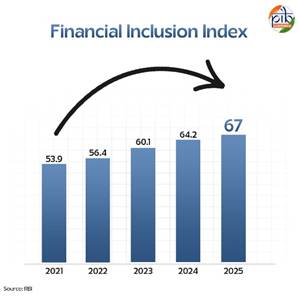

“Economic growth cannot only be restricted to a few cities and a few citizens. Development has to be all-round and all-inclusive,” said Prime Minister Narendra Modi, underlining India’s vision for inclusive prosperity. That vision is now visible in hard numbers. The Reserve Bank of India’s (RBI) Financial Inclusion Index (FI-Index) for March 2025 has surged to 67.0, up from 64.2 in 2024—an impressive 24.3% rise since 2021. The growth is powered by improved access, usage, and quality of financial services across urban, semi-urban, and rural India.

The FI-Index, launched in 2021, measures progress across banking, insurance, investment, pension, and postal sectors on a scale of 0 to 100, where 100 denotes full inclusion. The 2025 increase reflects deeper financial literacy, enhanced digital reach, and robust consumer protection frameworks.

Financial Inclusion: The Engine of Equitable Growth

Financial inclusion—providing affordable, accessible, and sustainable financial services—has become a cornerstone of India’s development agenda. It supports entrepreneurship, women empowerment, risk management, and economic growth, creating opportunities for individuals and small businesses alike.

Globally, financial inclusion is a key enabler of seven out of the 17 United Nations Sustainable Development Goals (SDGs). According to the World Bank’s Global Findex 2025, account ownership in India has risen to 89%, up from just 35% in 2011—a testament to the country’s rapid financial transformation.

Understanding the Financial Inclusion Index

The FI-Index comprises three sub-indices—Access (35%), Usage (45%), and Quality (20%)—based on 97 indicators.

- Access captures the supply side—like bank branches, ATMs, insurance offices, and digital payment touchpoints.

- Usage reflects how people actually use financial products such as savings, credit, insurance, and pensions.

- Quality assesses financial literacy, grievance redressal, and equitable access.

This data-driven framework allows policymakers to track inclusion progress and strengthen financial ecosystems where gaps exist.

Key Government Strategies Driving Inclusion

The government’s National Strategy for Financial Inclusion (2019–2024) and National Strategy for Financial Education (2020–2025) provide a clear roadmap. Together, they aim to deliver “Banking for All” through five pillars: access, education, protection, capability, and collaboration.

National Strategy for Financial Inclusion (NSFI)

- Universal Access: Ensuring every village has a formal financial access point within a 5 km radius.

- Basic Financial Services: Offering savings, credit, insurance, pension, and investment products to all adults.

- Livelihood Support: Linking financial inclusion with skill development and entrepreneurship.

- Financial Literacy: Delivering easy-to-understand, audiovisual learning materials for the masses.

- Grievance Redressal: Strengthening consumer protection systems for trust and transparency.

National Strategy for Financial Education (NSFE)

The NSFE promotes the “5C Approach”—Content, Capacity, Community, Communication, and Collaboration—to ensure that all stakeholders, from banks to schools, work in harmony to boost financial literacy nationwide.

Flagship Schemes Fueling Financial Empowerment

India’s inclusive financial architecture stands on the success of multiple government initiatives that reach the grassroots.

Pradhan Mantri Jan Dhan Yojana (PMJDY)

Often called a “financial revolution”, PMJDY has opened 55.98 crore accounts (as of August 2025), with women holding over 55% of them. Beneficiaries enjoy no-minimum-balance accounts, ₹10,000 overdraft, ₹1 lakh accident insurance, and access to digital payments via Rupay cards.

Pradhan Mantri Suraksha Bima Yojana (PMSBY)

With 50.54 crore enrollments since 2015, this accident insurance scheme provides ₹2 lakh coverage for just ₹20 per year, helping millions of low-income families stay financially secure.

Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY)

At ₹436 annual premium, this life insurance scheme has covered 23 crore Indians and provided financial assistance to over 9 lakh families.

Atal Pension Yojana (APY)

Aimed at the unorganised sector, APY has 7.65 crore subscribers and a total corpus of ₹45,974.67 crore as of April 2025. Nearly 48% of subscribers are women, underscoring the gender impact of India’s pension inclusion.

Pradhan Mantri MUDRA Yojana (PMMY)

Launched in 2015, MUDRA has sanctioned 53.85 crore loans worth ₹35.13 lakh crore, fueling micro-entrepreneurship across India. The introduction of Tarun Plus loans (₹10–₹20 lakh) and Credit Guarantee Fund for Micro Units (CGFMU) further strengthens MSME credit flow.

Stand-Up India Scheme (SUI)

Since its inception in 2016, SUI has facilitated loans worth ₹61,020 crore to SC, ST, and women entrepreneurs, driving grassroots entrepreneurship and employment.

Unified Payments Interface (UPI)

India’s digital payment champion—UPI—handled ₹24.03 lakh crore in June 2025 alone, across 18.39 billion transactions. Accounting for 85% of all digital transactions, UPI also powers 50% of global real-time payments, symbolizing India’s digital dominance.

Mahila Samriddhi Yojana (MSY)

This scheme empowers women through training and group loans of up to ₹1.4 lakh per group. By March 2025, ₹72,859 lakh had been disbursed to women-led self-help groups across India.

Kisan Credit Card (KCC)

KCC credit outstanding has grown from ₹4.26 lakh crore in 2014 to ₹10.05 lakh crore in 2024, benefiting 7.72 crore farmers and ensuring affordable credit for agricultural growth.

Campaign for Saturation of Financial Inclusion

The Department of Financial Services (Ministry of Finance) launched a three-month Saturation Campaign (July–September 2025) to ensure every unbanked citizen is covered under schemes like PMJDY, PMSBY, PMJJBY, and APY.

In just one month, 99,753 camps were held, leading to 6.65 lakh new Jan Dhan accounts and over 10 lakh KYC re-verifications—a strong indicator of India’s ground-level success in last-mile financial outreach.

A Future of Inclusive Prosperity

From digital banking units to grassroots campaigns, India’s financial inclusion movement has achieved remarkable milestones. The journey from financial exclusion to empowerment continues to be powered by innovation, collaboration, and government commitment.

As Prime Minister Modi envisioned, inclusive finance is now a national movement—bridging divides, empowering citizens, and ensuring that India’s economic growth truly means “growth for everyone.”

Source: PIB